20-Year-Old Doesn't Know the Difference Between Credit Limit and Credit Debt

Some people just shouldn't have credit cards. If you don't know the difference between credit limit and debt, that means you.

May 2 2024, Published 3:25 p.m. ET

There comes a time in every kid’s life when they get old enough to have their own credit card. First, they typically become a user on their parents’ credit card, and then, usually once they’re over 18 years old, they can open up their own credit. But it’s important to know what that actually means.

Twenty-year-old Rylie went on Caleb Hammer’s podcast, Financial Audit, to discuss her unique financial situation, which includes not knowing what a credit limit and credit debt are. A clip of this later went viral on TikTok. Caleb is judgmental, but he has every right to be according to the comments. But how could she have a credit card and not understand what it means?

Twenty-year-old Rylie doesn’t understand what a credit card limit is and uses “girl math” as an excuse.

In Caleb’s interview with Rylie, she explains that she proudly “maxed out” her credit card after her parents gave it to her. “With my credit card, I maxed that out to $4,000,” she shared as Caleb questioned her. “I got confused with the credit debt and credit limit,” she clarified.

“So my parents got me a credit card and I ended up getting a max credit limit of $8,000, so I could spend up to $8,000,” she continued. “That’s what that means, right? So I would use it and I would take my boyfriend, and we would go out, me and my boyfriend, me and my friends, we would go out and I’m like, ‘Oh, I’ll pay for everybody. I got it, I’ll spend the money, don’t worry about it, it’s just a credit card.’”

“So I would pay and pay and pay and pay,” she continued, “and then I called my mom one day and I wanted her to be proud of me, so I was just like, ‘Hey, I’ve got $4,000 credit on my credit card.’ And she’s like, ‘Credit limit or credit debt?’ I was like, ‘What’s debt?’” and Rylie laughed it off as Caleb looked ashamed. “And [my mom] is like, ‘Oh, that’s bad.’” Yes, it’s bad!

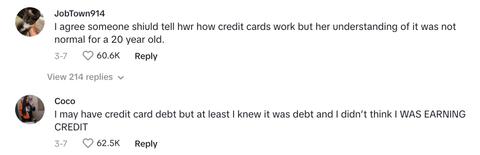

People are shocked at her misunderstanding of credit limit and debt

For some reason, Rylie’s parents thought it would be appropriate to give her a credit card without explaining that when she spends it, she’s still spending actual money. One commenter suggested that Riley thought it was more like a gift card, which would be a ridiculous thought. Why would your parents just gift you $8,000? That’s not how that works.

As she continues telling Caleb about her finances, between her $1,400 rent and $2,000 income, Caleb tries to tell her that she doesn’t have enough money to support herself, which she responds to by simply saying, “Girl math.” Riley, not all girls are bad at math and many of us know how to live independently. It’s actually such an anti-feminist cop-out to just blame any financial problems on “girl math.”

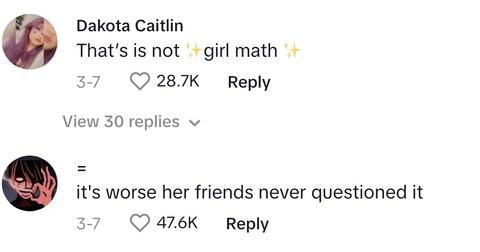

People agree that Riley's excuse is *not* "girl math"

Riley’s parents continue to support her in a way that is enabling her, according to Caleb and the commenters.

As more and more people tune into Riley’s story, they’re not only horrified by Riley’s financial habits but also by her parents’ habits. Riley explained that her parents are paying off the $4,000 she racked up on her credit card, meaning that Riley is facing no consequences for her actions. They don’t even get into the nitty-gritty of what it means to build up a good credit score and how that can impact her going forward.

Not only that, but Riley shared that when she wanted to move out, her parents offered to chip in on expenses where she may need it. It does sound like Riley is mostly supporting herself, but with her parents paying off her credit card debt and covering pop-up expenses, they are definitely not teaching her how to handle her own finances. At 20 years old, that might be okay, but if she always knows she has her parents to bail her out of trouble, she’ll never learn to be financially responsible.